Understanding the Concept of Wealth Windows

The concept of wealth windows refers to specific periods that present optimal opportunities for making financial decisions. These windows can occur on various time scales, including daily, monthly, and yearly cycles. Understanding wealth windows is crucial for anyone looking to maximize their financial outcomes, as they encapsulate the notion that time plays a pivotal role in financial success. By identifying these windows, individuals can develop strategies that align with favorable market conditions, ensuring decisions are made when the potential for returns is at its peak.

Daily wealth windows can vary based on market activity and investor behavior. For instance, stock prices often fluctuate throughout the trading day, creating windows of opportunity for day traders as they seek to capitalize on short-term movements. In a monthly context, wealth windows may correspond with the release of financial reports or economic indicators, which can influence investment strategies significantly. Seasonal patterns can also create distinct monthly wealth windows, as certain industries experience fluctuating demand at different times of the year.

From an annual perspective, wealth windows are often defined by fiscal calendars, tax seasons, and long-term investment cycles. Understanding these time frames allows investors to position themselves strategically in alignment with broader economic trends, enhancing the potential for wealth accumulation. Moreover, the psychological dimensions of these wealth windows cannot be overstated. Emotional factors often come into play, with psychology influencing timing in decision-making processes. Fear and greed can lead to poor choices if one ignores the significance of timing. Recognizing wealth windows, coupled with an understanding of emotional triggers, can empower individuals to make more rational and informed financial decisions.

Identifying Key Financial Decision-Making Periods

Understanding key financial decision-making periods is vital for individuals and businesses aiming to optimize their financial outcomes. Certain times during the calendar year present unique opportunities and challenges that can greatly impact financial strategies. Significant events, like the commencement of a fiscal year, are essential markers for revisiting budgets and resource allocations. It is during these early months that businesses often reassess their financial goals and adjust their plans accordingly.

Another critical period is tax season, typically the first quarter of the year. This timeframe not only requires individuals to file their taxes but also encourages them to evaluate their financial health comprehensively. Analyzing prior year’s financial performance during tax preparation can provide insights that shape future investments, savings, or expenditures. Furthermore, tax season often coincides with changes in tax laws, which can affect personal and business finances directly.

Economic indicators such as interest rate fluctuations or market trends must also be monitored closely. For instance, when central banks announce changes in interest rates, individuals and businesses should consider re-evaluating loans, mortgages, or investment portfolios as these can significantly affect cash flow and overall financial health. Keeping an eye on market trends can also signal optimal times to buy or sell assets, allowing individuals to leverage their investments more effectively.

In addition to these calendar events, personal milestones are pivotal as well. Events like career transitions, marriage, or the birth of a child can prompt significant financial decision-making. During such life changes, it is essential to reassess financial priorities and adjust budgets accordingly. Recognizing these pivotal periods, both external and internal, equips individuals and businesses with the insight necessary to make informed financial choices, ultimately contributing to more effective wealth management strategies.

Strategies for Leveraging Wealth Windows

Leveraging wealth windows effectively requires a forward-thinking approach and strategic planning. Preparation is key to maximizing financial opportunities as they arise. One of the first steps in this process is to establish clear financial goals that correspond with these wealth windows. Financial objectives should be both realistic and measurable, promoting a focus on what truly matters, whether that pertains to saving for retirement, funding education, or making significant investments. By tracking progress against these goals, individuals can maintain motivation and adjust strategies when necessary.

Investment strategies play a crucial role in capitalizing on wealth windows. Diversification is essential; a well-structured portfolio that spans multiple asset classes can help mitigate risks during market volatility. Investors are encouraged to consider a mix of stocks, bonds, real estate, and alternative assets tailored to their risk tolerance and investment horizon. Additionally, exploring tax-advantaged accounts, such as IRAs or 401(k)s, can further enhance wealth accumulation during these periods by taking advantage of tax benefits available to individuals.

Equally important is the implementation of disciplined savings plans and budgeting approaches. Budgeting allows individuals to allocate a portion of their income to savings and investments systematically. Creating a detailed budget can reveal opportunities to reduce unnecessary expenditures and redirect those funds toward wealth-building activities. Furthermore, utilizing budgeting tools and apps can help individuals manage their finances more efficiently, providing visibility into spending habits and cash flow management.

In conclusion, by setting appropriate financial goals, adopting sound investment strategies, and maintaining disciplined budgeting practices, individuals can position themselves to make the most of wealth windows when they emerge. These preparations will not only enhance their financial health but also empower informed decision-making, transforming potential opportunities into tangible financial growth.

Common Pitfalls and How to Avoid Them

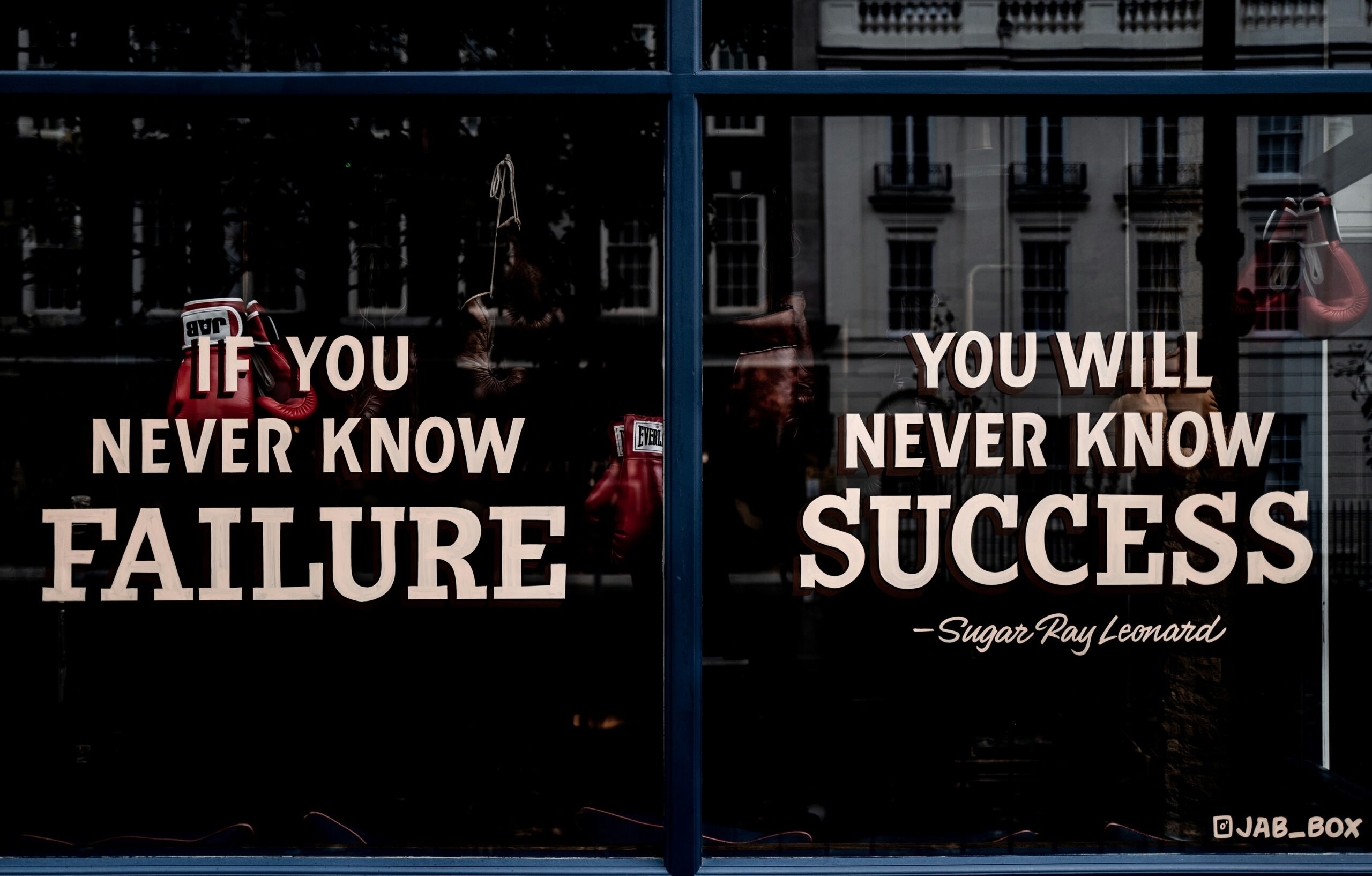

When strategizing financial decisions during wealth windows, individuals often fall prey to a variety of common pitfalls that can hinder their financial success. One of the most significant dangers is the tendency to make impulsive decisions based on time constraints or emotional triggers. The pressure to act quickly can lead to choices made without adequate research or consideration, which can have detrimental effects on one’s financial future. Therefore, prioritizing diligence in due process is crucial for well-informed decision-making.

Additionally, external influences such as media hype and peer pressure can skew an individual’s perspective on financial matters. The prevalence of sensationalized news coverage or social comparisons may prompt decisions that are not aligned with one’s personal financial goals. It is essential to recognize the impact of these external factors and remain focused on individual circumstances, needs, and long-term objectives. Seeking reliable information and maintaining a critical eye on media narratives can mitigate the risks associated with these external influences.

To ensure that financial decisions made during these critical times are rooted in facts rather than emotions or peer influence, it is advisable to adopt a methodical approach. Consider documenting financial goals and the criteria for decision-making. Setting clear benchmarks allows for reflection and thoughtful assessment before acting. Additionally, consulting with financial professionals can provide the necessary expertise and guidance, further enhancing the decision-making process.

Conducting thorough research and seeking multiple perspectives can also bolster one’s confidence in the choices made. By taking these proactive measures, individuals can navigate wealth windows more effectively, avoiding common mistakes and fostering a more stable financial future.

Wake Up and Smell the Motivation

Ah, the elusive butterfly of motivation! It flutters just out of reach when you need it the most. You wake up, your alarm clock sounds like a dying horse, and suddenly the couch looks like the best option in the world. But let’s toss that blanket of defeat aside and frame this moment as an opportunity! Remember, the only difference between a goal and a wish is some serious motivational hustle.

The Power of Positive Nonsense

Engaging in positive self-talk may sound like something the overly cheerful neighbor does, but trust me, it’s more than just a quirky habit. When you start your day with a sprinkling of affirmations, it’s like giving your brain a shot of espresso. Instead of saying, “I can’t do this,” try something like, “I’m so fabulous, even my goals want to hang out with me!” You’ll soon see how those small phrases pinky swear to keep negativity at bay.

Shoutout to Progress, Not Perfection

Let’s get real for a second: perfection is an illusion crafted by people who have never tried to bake a soufflé. Motivation isn’t about chasing a flawless version of yourself; it’s about celebrations for progress—no matter how small! Did you get out of bed? Bravo! Did you eat breakfast? Applause! Little by little, every step counts toward achieving the goals you’ve set.

So, grab your metaphorical pom-poms and cheer for yourself. You’re capable of amazing things! Remember, the journey of a thousand miles begins with a single, often reluctant, step. And who knows? That stubborn butterfly might just decide to settle on your shoulder along the way!