Understanding the Debt Cycle

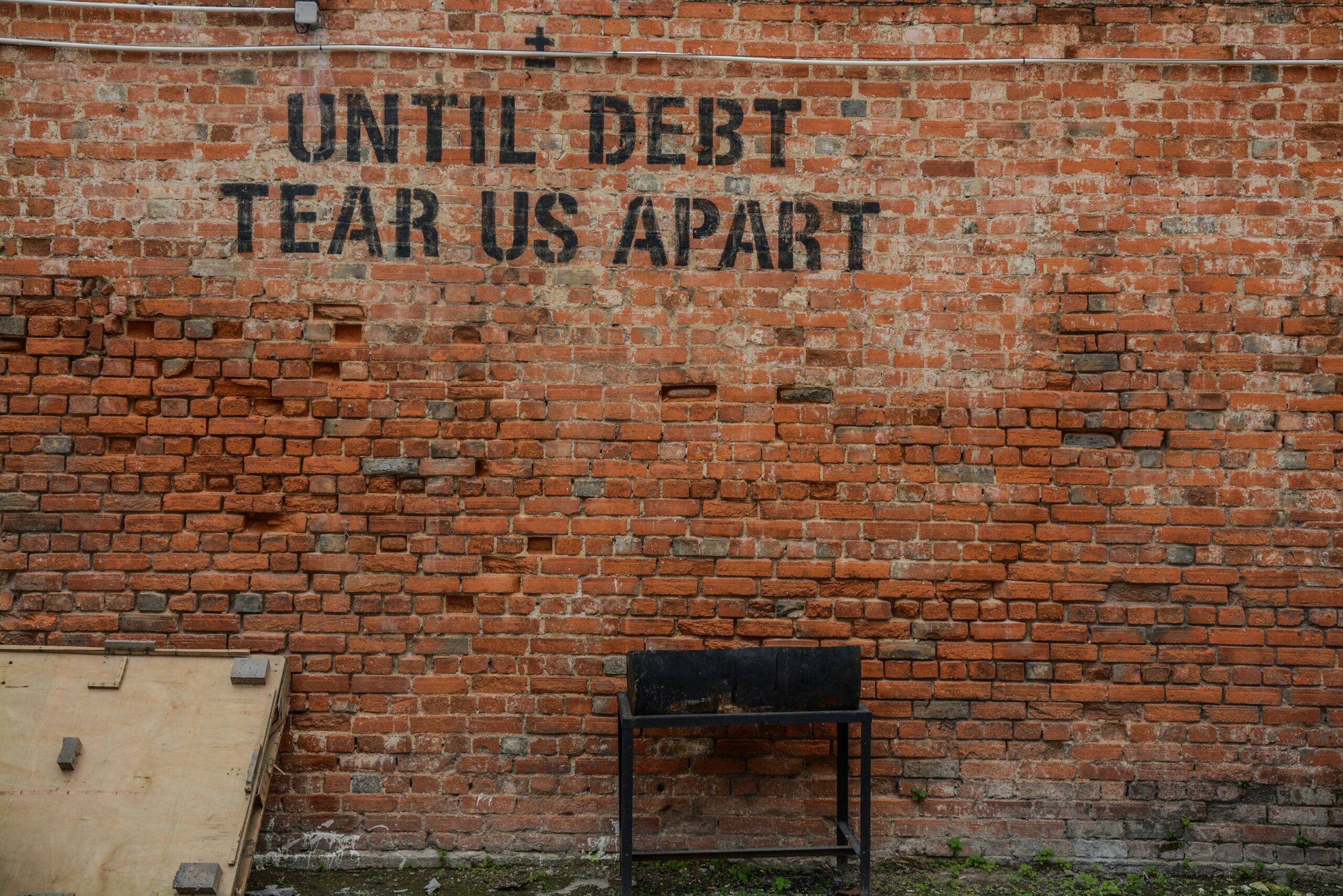

The debt cycle is a pervasive phenomenon that affects individuals across various demographics. It often begins innocently enough, when individuals take on manageable debt, such as a credit card balance or a loan. However, the situation can quickly escalate when the debts accumulate and repayments become overwhelming. This leads to a cycle of borrowing and repayment where the borrower takes on additional debt to cope with existing financial commitments, ultimately trapping them in a state of perpetual debt.

Psychologically, being in debt can manifest as chronic stress, anxiety, and even depression. Individuals may experience feelings of shame or embarrassment about their financial situations, which can hinder their ability to seek help or take action. The emotional impacts of debt often extend beyond the individual, affecting relationships with family and friends. The stress-related repercussions can lead to a decrease in overall well-being, making it imperative that individuals understand not only the mechanics of this cycle but also its contributing factors.

Common triggers that can exacerbate the debt cycle include unexpected expenses, lifestyle inflation, and inadequate financial literacy. A sudden medical emergency or job loss can force individuals to rely on borrowing, leading to an unmanageable debt load. Additionally, societal pressures to maintain a certain lifestyle may compel individuals to live beyond their means, further entrenching them in debt.

Recognizing these patterns is crucial in breaking free from the debt cycle. By understanding the dynamics at play and the emotional toll it takes, individuals can begin to implement strategies that foster financial resilience. This understanding lays the groundwork for reclaiming financial freedom and alleviating the stress associated with debt, which is essential for achieving long-term stability and peace of mind.

Recognizing Your Debt Situation

To embark on the journey towards financial freedom, the first crucial step is to assess your current debt situation accurately. This involves taking a comprehensive inventory of all existing debts. Begin by listing every account, which includes credit cards, mortgages, personal loans, and any other forms of debt. Ensure that you note down the total amount owed on each account, the minimum monthly payments required, and the respective due dates. This thorough documentation will provide a clear picture of your financial obligations.

Next, it is essential to understand the interest rates associated with each debt. Different debts may incur varying interest rates, often influenced by factors such as the type of borrowing and your creditworthiness. By calculating the total interest accrued on your debts, you can gain insights into which debts are costing you the most over time. This knowledge is key in prioritizing repayments based on maintaining financial stability.

Furthermore, categorize your debts based on priority. This categorization typically involves distinguishing between secured and unsecured debts. Secured debts, such as mortgages or auto loans, are backed by assets, making them a priority to manage due to the risk of losing these assets. Unsecured debts, like credit card balances or personal loans, can be categorized later as these generally incur higher interest rates. Understanding the different categories allows for a strategic approach to debt management, ensuring that essential obligations are met while working towards a feasible repayment plan.

Ultimately, recognizing your debt situation forms the foundation for achieving long-term financial stability. This assessment not only aids in developing a personalized repayment strategy but also empowers you to take control of your financial future. With a clear understanding of what you owe, you can effectively navigate the path to eliminating debt and reclaiming financial independence.

Creating a Realistic Budget

Budgeting is a cornerstone of financial management, especially for individuals seeking to escape the grips of debt. A realistic budget not only aids in understanding one’s income and expenses but also serves as a roadmap for achieving financial goals. The first step in creating a budget is to calculate total monthly income. This includes all sources of revenue, such as salaries, bonuses, and any side hustles. Once the income is established, it is essential to list all monthly expenses, which should be categorized into fixed and variable costs. Fixed expenses, or non-negotiables, may include rent or mortgage, utilities, and insurance, while variable expenses cover areas such as groceries, entertainment, and dining out.

After identifying both income and expenses, individuals must prioritize essential expenses while allocating a specific portion of their income towards debt repayment. The 50/30/20 rule is a commonly utilized budgeting framework, designating 50% of income for needs, 30% for wants, and 20% for savings and debt reduction. This structured approach not only ensures that necessary expenses are met but also paves the way for gradually reducing debt over time.

Minimizing unnecessary expenditures is vital to adhering to a budget. Evaluate and identify areas where spending can be trimmed. For instance, replacing dining out with home-cooked meals or reducing subscription services can free up additional funds for debt repayment. Setting limits on discretionary spending can also aid in curtailing impulse purchases. Finally, tracking spending in real-time, through methods like budgeting apps or spreadsheets, can enhance accountability and highlight spending patterns that may require adjustments.

Essentially, a realistic budget acts as a framework that allows for both necessary expenditures and strategic debt repayment, thus fostering financial stability and the eventual escape from debt. By rigorously following a budget and remaining flexible to necessary adjustments, individuals can reclaim control over their finances and work toward achieving lasting financial freedom.

Exploring Debt Repayment Strategies

When dealing with debt, selecting the right repayment strategy is critical in achieving financial freedom. Among the most popular methods are the snowball method, avalanche method, and debt consolidation. Each strategy has its own unique characteristics, advantages, and disadvantages, which can significantly impact an individual’s path toward debt repayment.

The snowball method focuses on repaying the smallest debts first, regardless of interest rates. This approach allows individuals to experience quick wins, boosting motivation as debts are cleared. However, the downside is that it may result in paying more interest over time. Conversely, the avalanche method prioritizes debts by interest rate, paying off the highest-rate debts first. This strategy can save money in interest payments overall but may not provide the immediate satisfaction that the snowball method offers. Choosing between these two methods largely depends on whether an individual values emotional motivation or financial efficiency more.

Another option worth considering is debt consolidation. This involves combining multiple debts into a single loan, often with a lower interest rate. This can simplify payments by reducing them to one monthly installment, making it easier to manage finances. While debt consolidation can offer lower interest rates and improved cash flow, it requires discipline to ensure that reaccumulation of debt does not occur. By assessing the current financial situation, including income and existing debts, individuals can determine whether this strategy aligns with their repayment goals.

Ultimately, the choice of a debt repayment strategy depends on personal circumstances, including debts owed, income levels, and individual financial goals. It is essential to consider the pros and cons of each approach and select a method that resonates with one’s financial mindset and commitment to changing their financial future.

Increasing Your Income Streams

In the pursuit of financial freedom, increasing your income streams is a critical element that can significantly accelerate debt repayment. Relying solely on a single source of income can leave you vulnerable to unexpected financial challenges. Therefore, diversifying your income can provide much-needed security and contribute positively to your overall financial health.

One effective method to enhance your income is by starting a side hustle. This could range from offering freelance services such as graphic design, writing, or consulting, to starting an online store. The internet has enabled individuals to monetize their skills and passions in various ways, whether it’s through e-commerce platforms or service-based websites. For instance, if you have expertise in a particular field, consider teaching online courses or creating digital products, which can not only supplement your income but also potentially grow over time.

Additionally, negotiating a raise at your current job is another way to increase your income without the need to invest extra time in a side venture. Preparing a solid case for your value to the company can lead to a successful negotiation. Focus on documenting your accomplishments and contributions that align with the company’s goals to help justify your request for a salary increase.

Moreover, investments can serve as a passive income stream. Although this often requires an initial capital outlay, strategic investments in stocks, bonds, or real estate can yield returns that bolster your overall financial profile. Understanding risk tolerance and conducting comprehensive research before committing to any investment is essential.

In summary, enhancing your income through various avenues not only assists in alleviating debt stress but also fosters a sense of financial security. Embrace the opportunity to explore side hustles, invest wisely, and advocate for yourself in the workplace to create a multi-faceted income strategy that supports your long-term financial objectives.

Seeking Professional Help and Resources

For individuals grappling with significant debt, the prospect of effectively managing financial burdens can be daunting. Recognizing when to seek professional assistance is crucial in navigating this challenging landscape. Numerous resources are available, ranging from credit counseling services to debt management plans and even bankruptcy options. Each of these approaches can provide different benefits, depending on one’s unique financial situation.

Credit counseling services serve as an excellent first step for individuals feeling overwhelmed by their debt. These organizations offer confidential consultations where trained counselors assess one’s financial status, help create budgets, and develop personalized plans to manage debt. Choosing a reputable credit counselor requires some research. Look for non-profit organizations accredited by established bodies, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Debt management plans are another resource to consider, particularly if thecreditor agrees. These plans typically involve consolidating your debts into a single monthly payment administered by a credit counseling agency. This option can simplify debt repayment and possibly reduce interest rates or eliminate late fees. However, it is essential to ensure that the agency administering the plan is credible and transparent about fees and policies.

In some severe cases, individuals may consider bankruptcy as a viable route to relieve financial stress. However, this should be viewed as a last resort due to its enduring impact on credit scores and financial reputation. Consulting with a bankruptcy attorney can clarify whether filing for bankruptcy aligns with your financial goals and offers a fresh start. Such legal professionals can guide individuals through the complexities of bankruptcy laws and assist in evaluating alternative options before making this critical decision.

Utilizing these resources can help individuals in debt regain control over their finances and work towards financial freedom. Remember, seeking professional help is a sign of strength, and taking proactive steps can pave the way toward a more secure financial future.

Building an Emergency Fund

Establishing an emergency fund is a crucial step in maintaining financial stability and preventing the accumulation of further debt. An emergency fund acts as a financial buffer, providing peace of mind and a safeguard against unforeseen expenses, such as medical emergencies or unexpected car repairs. Without this cushion, individuals may be tempted to rely on credit cards or loans, which can lead to a cycle of borrowing and increased debt burden.

To begin building an emergency fund, it is wise to set a realistic target. Ideally, aim for three to six months’ worth of living expenses. However, if this seems unattainable, start with a smaller goal, such as $500 or $1,000. This initial amount can cover minor emergencies and encourage further saving. This process can begin while still focusing on repaying existing debts, as prioritizing financial obligations is essential.

Saving money effectively often involves cutting unnecessary expenses. Take a close look at your budget and identify areas where you can reduce spending, such as dining out less, canceling unused subscriptions, or finding cheaper alternatives for necessary expenses. Moreover, consider setting aside a specific amount from each paycheck into a separate savings account dedicated solely to the emergency fund. Automating this transfer can alleviate the temptation to spend this money elsewhere.

Additionally, finding ways to generate extra income can significantly aid in building your emergency fund. Part-time work, freelance opportunities, or selling unneeded possessions can provide additional funds for savings. Even small contributions to your emergency fund will help build it over time. The key is consistency and commitment. By taking these steps, you can create a safety net that secures your financial future and aids in preventing the stress associated with unexpected expenses.

Mental and Emotional Wellness Strategies

Debt is often referred to as a prison, not just for the financial burden it imposes but also for the strain it can place on mental and emotional well-being. When individuals face overwhelming debt, feelings of anxiety and depression can become prevalent, severely affecting overall health. Consequently, prioritizing mental and emotional wellness becomes pivotal during the debt repayment journey.

One effective strategy for managing stress associated with debt is practicing mindfulness. Mindfulness involves focusing on the present moment and allowing oneself to experience thoughts and feelings without judgment. Techniques such as deep breathing, meditation, or yoga can create a sense of calm, helping individuals to distance themselves from stressors related to their financial situation. Incorporating even a few minutes of mindfulness practice daily can significantly reduce anxiety levels and improve clarity in decision-making regarding debt management.

Additionally, maintaining a positive mindset is essential. It is easy to fall into a cycle of negative thinking when faced with significant financial challenges, but fostering an optimistic outlook can be transformative. Setting small, achievable goals related to debt repayment can provide a sense of accomplishment and motivate individuals to continue on their path towards financial freedom. Celebrating these milestones, no matter how minor, reinforces a positive self-image and encourages perseverance.

Another important aspect of emotional wellness during this journey is self-care. Engaging in activities that bring joy and relaxation—be it reading, spending time with loved ones, or pursuing a hobby—can serve as a vital counterbalance to the stress of debt. Ensuring adequate rest and nutrition also supports emotional resilience, making it easier to cope with challenges that arise. In recognizing the interconnectedness of emotional health and financial management, individuals can create a sustainable approach to overcoming debt and reclaiming their financial freedom.

Staying Committed to Financial Freedom

Achieving financial freedom is an ongoing journey that requires commitment, discipline, and continual assessment of one’s financial habits. To remain steadfast in your pursuit of a debt-free life, it is crucial to establish clear financial goals and keep them at the forefront of your daily activities. This might involve breaking down larger objectives into manageable milestones, allowing you to track progress and celebrate small wins along the way. Each step, regardless of its size, contributes to the overall narrative of your financial independence, providing motivation and reinforcing positive behaviors.

Utilizing budgeting tools and financial tracking apps can greatly enhance your ability to monitor expenses and savings. These tools offer visual representations of your financial landscape, making it easier to identify spending patterns and areas that might require adjustment. Regularly updating your budget and reflecting on your financial decisions aids in maintaining a disciplined approach to your finances. Another effective strategy is to establish a support network, whether through family, friends, or online communities. Sharing your goals and progress with others can create a sense of accountability, increasing your motivation to stay on course.

It is equally important to recognize pitfalls that may impede your progress. Common distractions include lifestyle inflation, impulsive spending, and comparing yourself to others. By remaining aware of these challenges, you can develop strategies to navigate them creatively. For example, practicing mindfulness when making purchasing decisions can prevent unnecessary expenses that threaten your financial plan.

Incorporating these strategies will provide you with a resilient framework to nurture your commitment to financial freedom. As you reflect on your achievements, both big and small, remember that this journey is unique to you. Stay focused and adaptable, and you will find success in reclaiming your financial health.